401k distribution calculator fidelity

Fidelity Investments - Retirement Plans Investing Brokerage Wealth. This calculator is for educational use only illustrating how different user situations and decisions affect a hypothetical retirement income plan and should not be the basis for any investment.

The 9 Most Common Small Business 401k Mistakes Above The Canopy Small Business 401k Small Business Resources 401k

Second many employers provide.

. Discover The Answers You Need Here. This calculator is designed to show you how making a pre-tax contribution to your retirement savings plan could affect your take home pay. This guide may help you avoid regret from certain financial decisions with 500000.

Fidelity Workplace Can Help Manage Your Employees Benefits. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year. Ad If you have a 500000 portfolio download 13 Retirement Investment Blunders to Avoid.

Ad Learn About the Benefits Solution Backed By the Expertise of Fidelity. 401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator. Offer Your Clients Lower Costs and Less Complexity with SIMPLE IRAs.

Ad Explore Fidelitys Wide Range of Mutual Funds With Zero Minimum Investment. Fidelity Workplace Can Help Manage Your Employees Benefits. Ad Get Free Quotes From 31 Top Rated Companies.

Using this 401k early withdrawal calculator is easy. Use this calculator to estimate how much in taxes you could owe if. When you make a pre-tax contribution to your.

First all contributions and earnings to your 401 k are tax-deferred. You only pay taxes on contributions and earnings when the money is withdrawn. The Internal Revenue Code sections 72 t and 72 q allow for penalty free early withdrawals from retirement accounts.

Ad Learn About the Benefits Solution Backed By the Expertise of Fidelity. The IRS limits how much can be withdrawn by assuming any future. Ad Designed for Small Businesses These Solutions Feature Easy Plan Design Administration.

Enter the current balance of your plan your current age the age you expect to retire your federal income tax bracket state income tax.

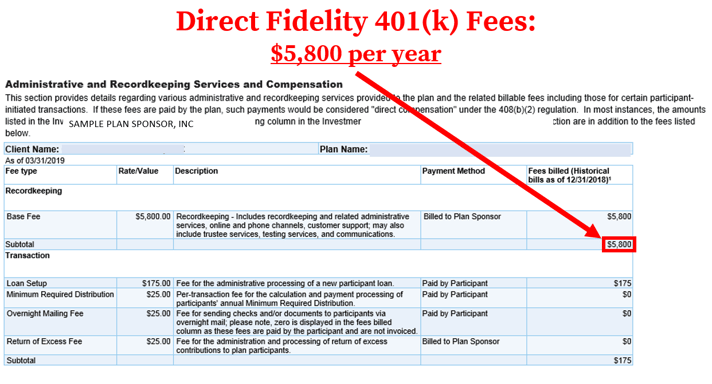

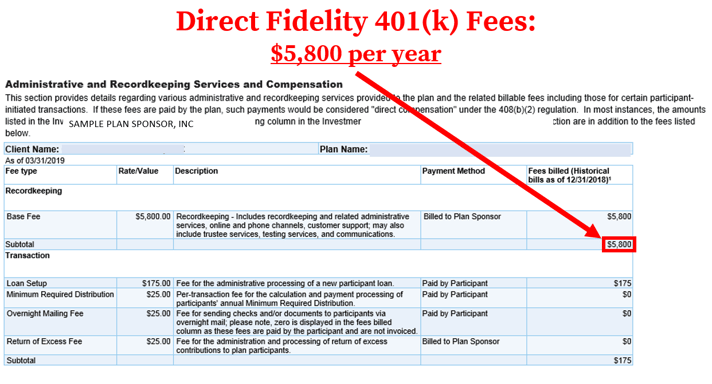

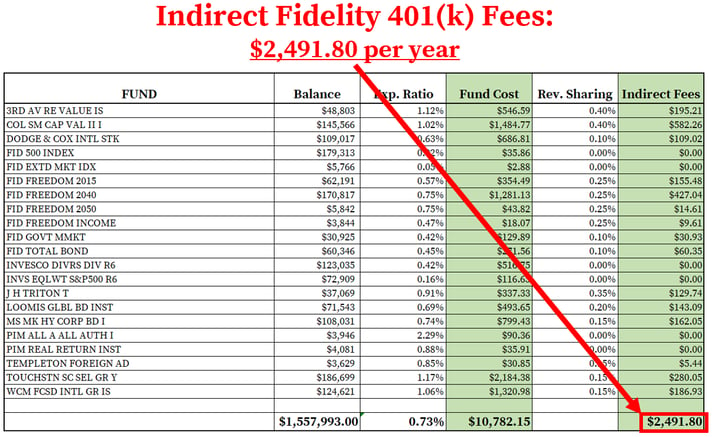

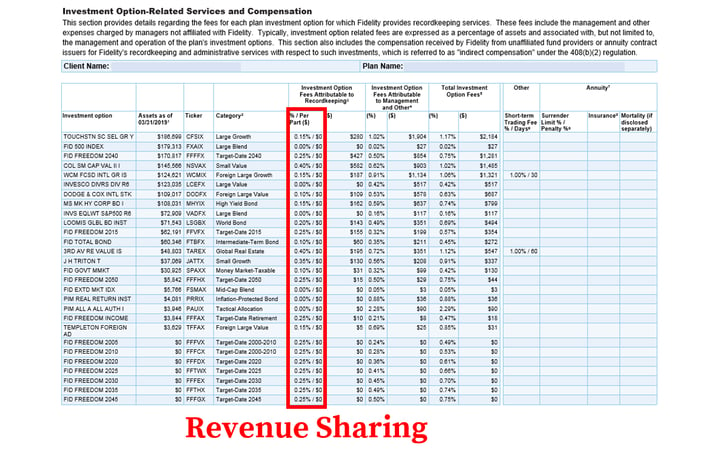

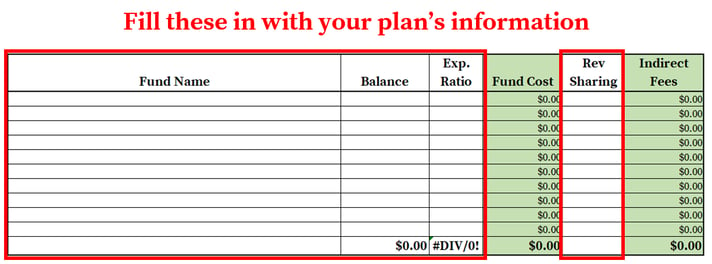

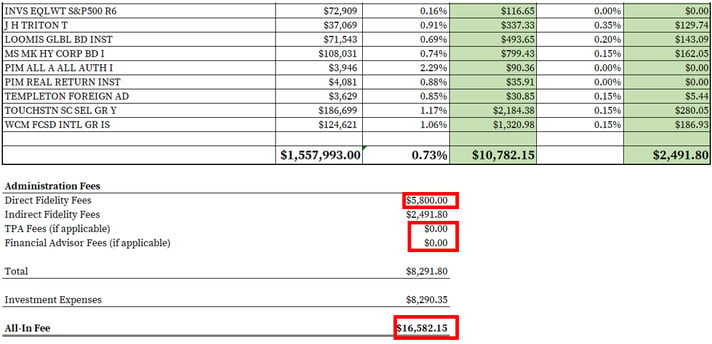

How To Find Calculate Fidelity 401 K Fees

How To Find Calculate Fidelity 401 K Fees

How To Find Calculate Fidelity 401 K Fees

Retirement Planning And Guidance Fidelity

What Is A Roth Ira And Do You Really Need One Adopting A Lifestyle Roth Ira Investing Investing Money Investing

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

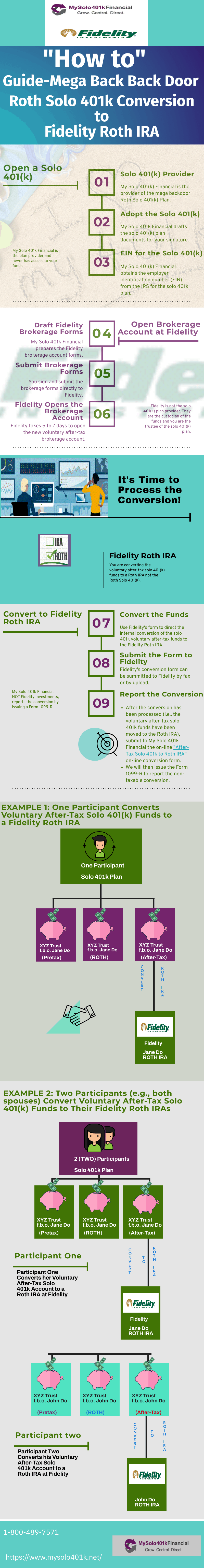

How To Process A Fidelity Investments Conversion Of Voluntary After Tax Solo 401k Funds Non Prototype Account To A Fidelity Roth Ira My Solo 401k Financial

What Happens When You Inherit An Ira Or 401 K

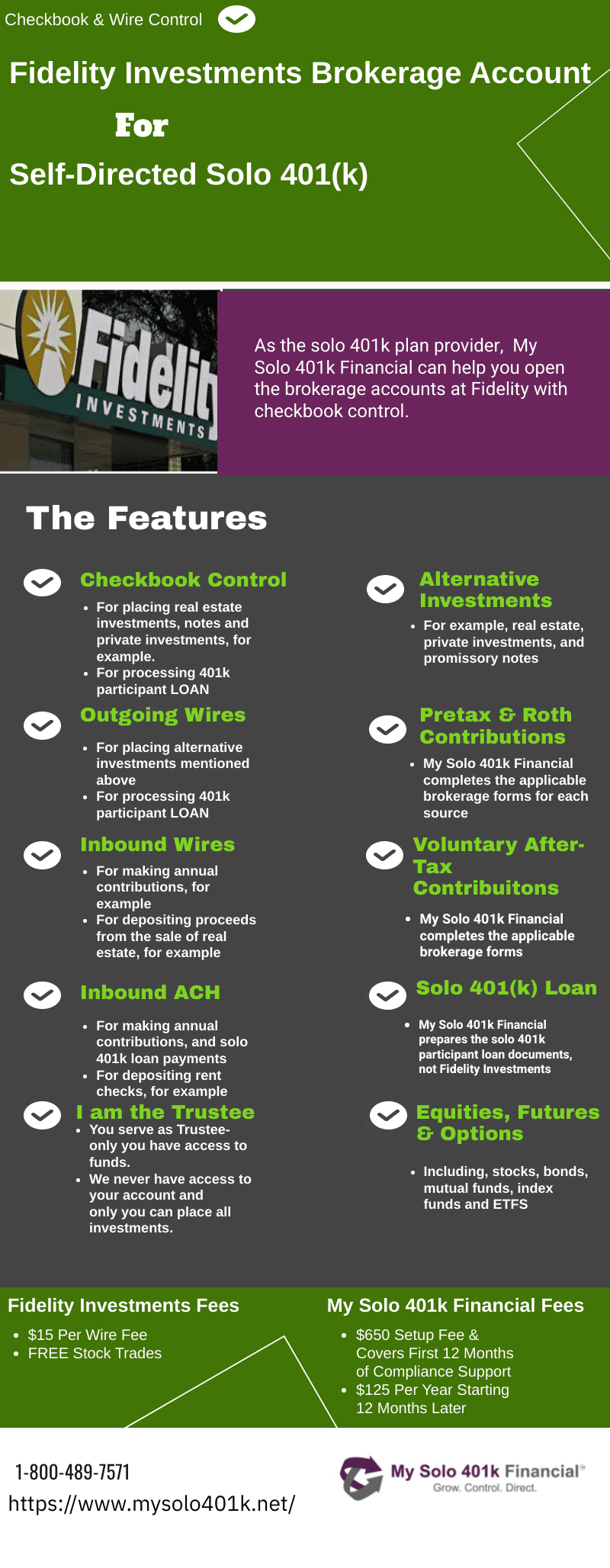

Fidelity Solo 401k Brokerage Account From My Solo 401k

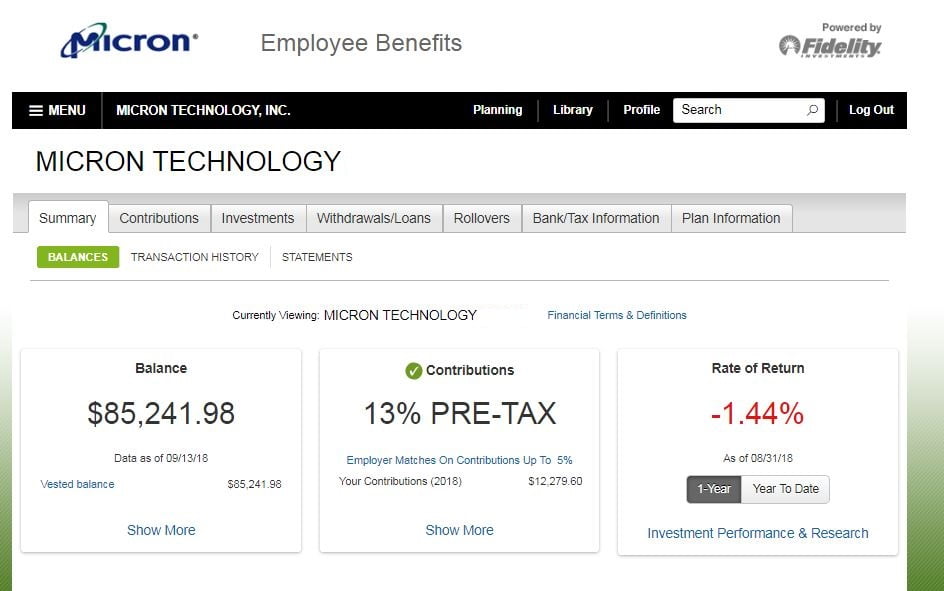

401k Fidelity Net Benefits Our Debt Free Lives

Contributing To Your Ira Start Early Know Your Limits Fidelity

How To Find Calculate Fidelity 401 K Fees

Fidelity Go Review Smartasset Com

How To Roll Over Your 401 K To An Ira Smartasset Saving For Retirement How To Plan 401k Plan

Listing Of All Tools Calculators Fidelity

How To Find Calculate Fidelity 401 K Fees

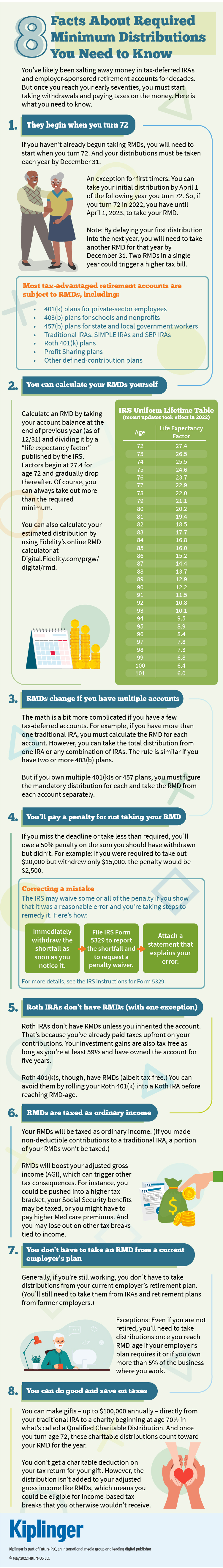

8 Facts About Required Minimum Distributions You Need To Know