Beneficiary ira rmd calculator

IRA Beneficiary Calculator Beneficiary Required Minimum Distribution Calculate your earnings and more When you are the beneficiary of a retirement plan specific IRS rules regulate the. This calculator follows the SECURE Act of 2019 Required Minimum Distribution RMD rules.

After Death Required Minimum Distribution Rules After The Secure Act Dbs

This calculator has been updated to reflect the new.

. How is my RMD calculated. Beneficiary IRA Beneficiary IRA Distribution Calculator This calculator helps you assist an IRA beneficiary in calculating the amount heshe is required to withdraw each year from the. Ad Manage Your Retirement Savings Through Fidelitys Range of Options for Your IRA.

Use this calculator to determine your Required Minimum Distributions RMD as a beneficiary of a retirement account. Use our Inherited IRA calculator to find out if when and how much you may need to take depending on your age. The SECURE Act of 2019 changed the age that RMDs must begin.

2022 Retirement RMD Calculator Important. Discover Fidelitys Range of IRA Investment Options Exceptional Service. As a beneficiary you may be required by the IRS to take.

Beneficiary RMD Calculator Beneficiaries of a retirement plan can choose to keep the assets in a tax-deferred inherited IRA account. Ad Top Rated Gold Co. Ad We Reviewed the 10 Best Gold IRA Companies For You to Protect Yourself From Inflation.

When a beneficiary becomes entitled to an IRA from an account owner who died before he or she was required to begin taking RMDs April 1st of the year following the year in which the owner. If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from. Paying taxes on early distributions from your IRA could be costly to your retirement.

Ad Use This Calculator to Determine Your Required Minimum Distribution. By thousands of Americans. Ad Learn more about Fisher Investments advice regarding IRAs taxable income in retirement.

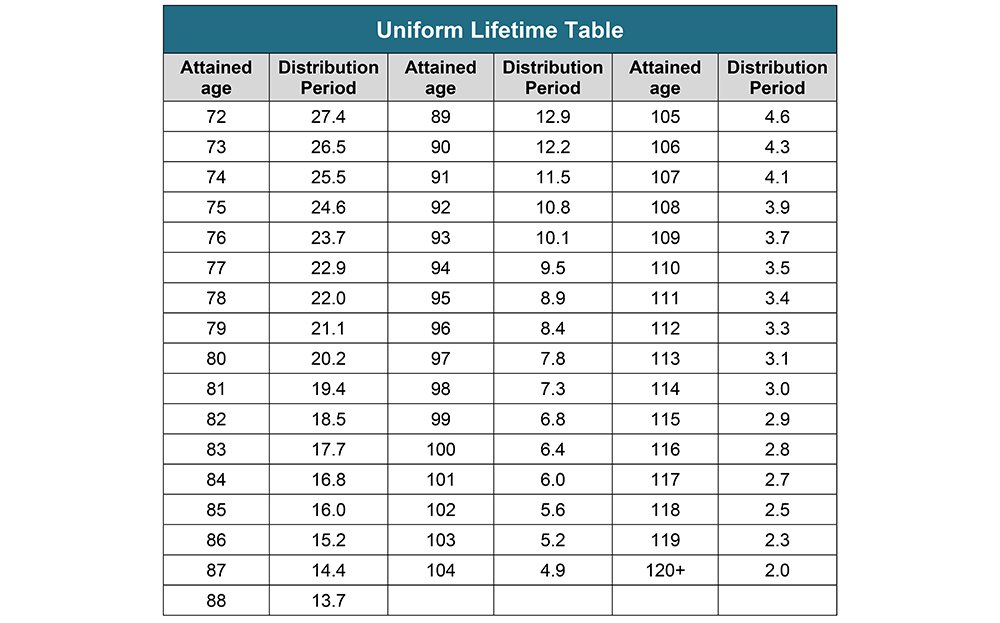

Calculate the required minimum distribution from an inherited IRA. Protect your retirement with Goldco. Distribute using Table I.

If inherited assets have been transferred into an inherited IRA in your name. This calculator has been updated for the SECURE Act of 2019 and CARES. Ad Manage Your Retirement Savings Through Fidelitys Range of Options for Your IRA.

As part of the bipartisan COVID-19 stimulus bill Congress suspended required minimum distributions for 401k and IRA plans for 2020. 0 Your life expectancy factor is taken from the IRS. Estimate annual minimum withdrawals you may be responsible to take from your inherited IRA using an inherited IRA RMD calculator from MetierEX.

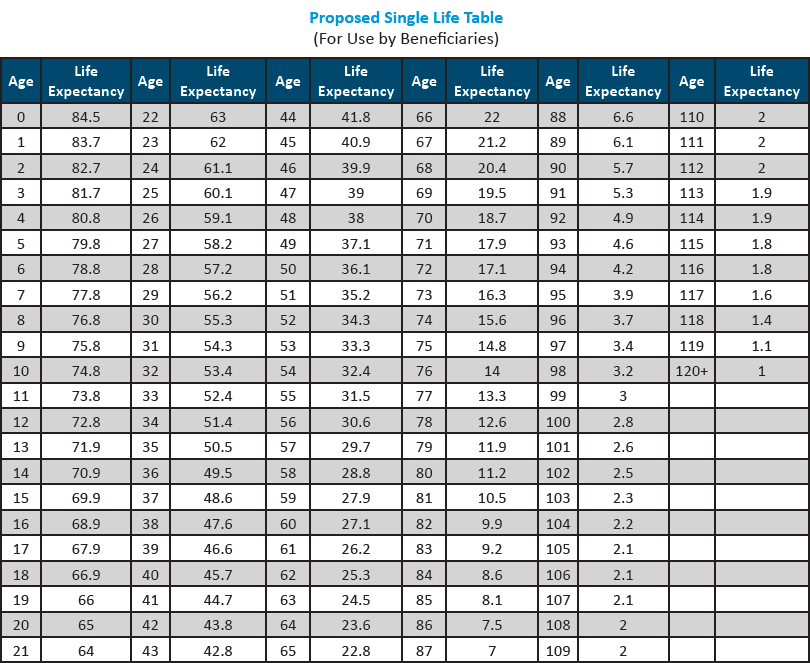

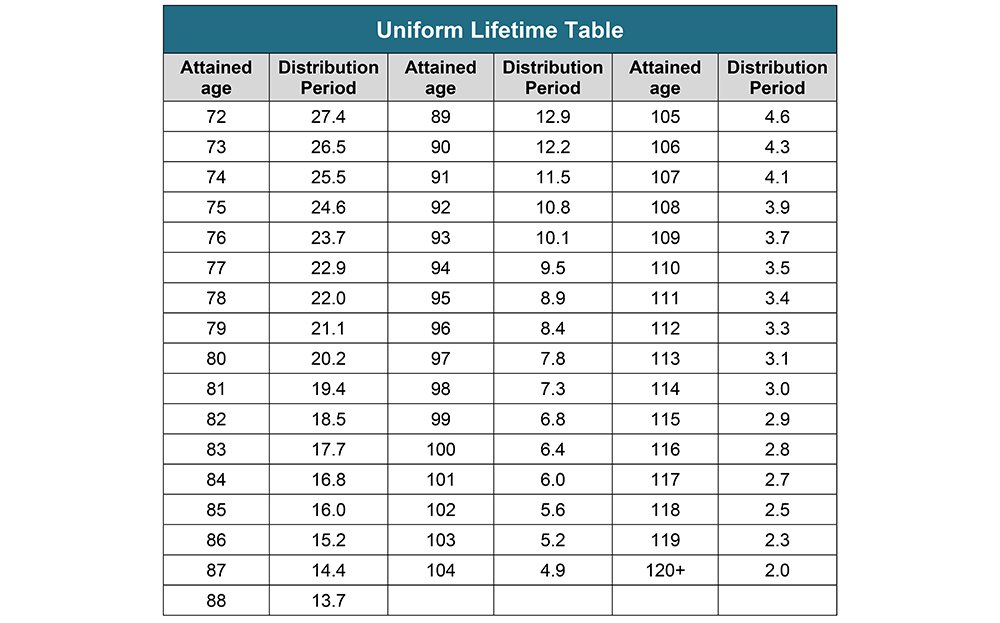

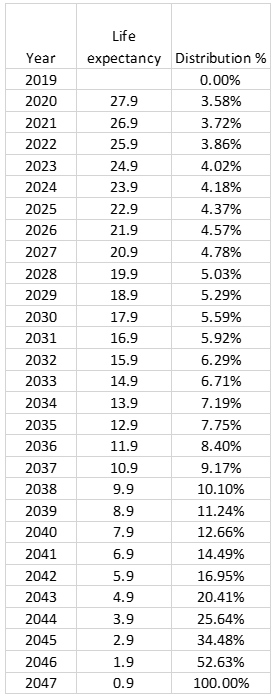

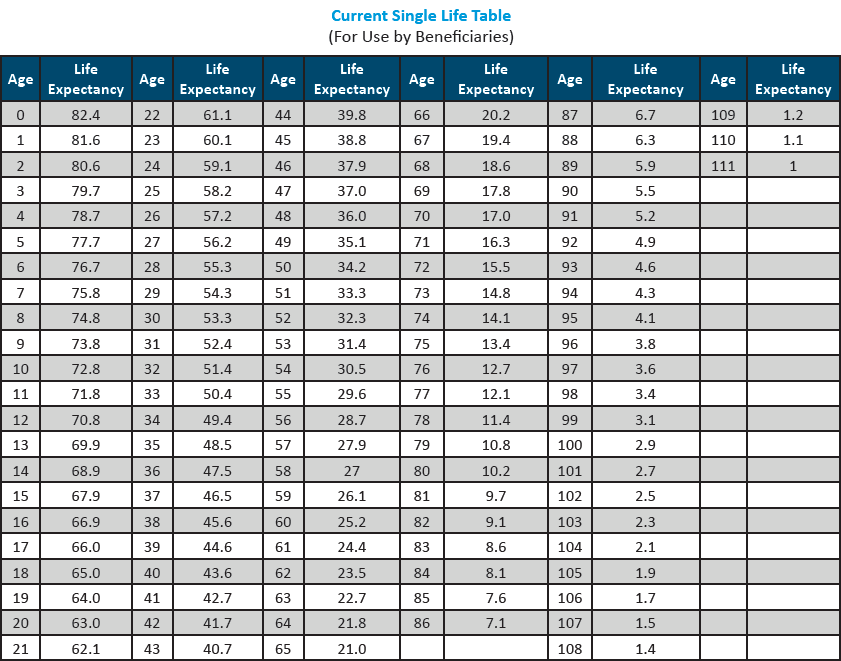

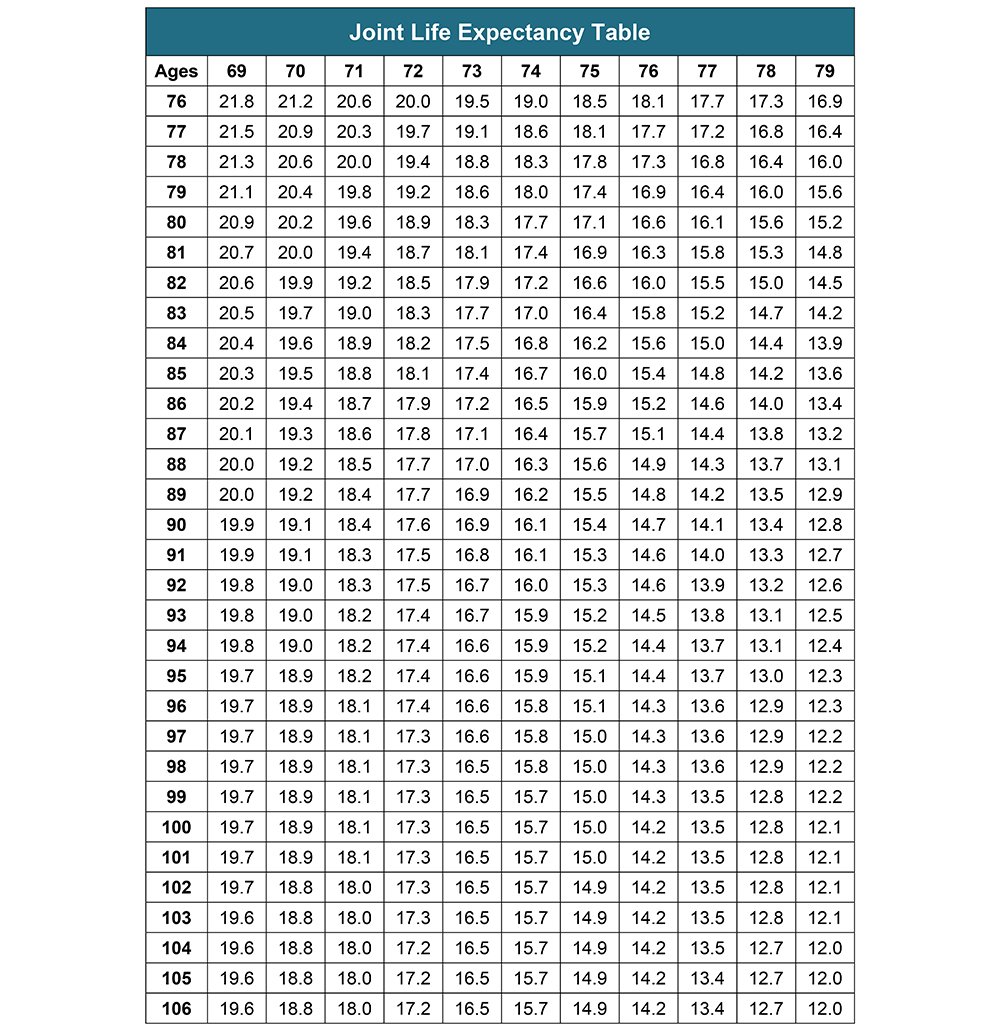

First we find the original life expectancy using the Single Life Expectancy table and the beneficiarys age on December 31 st of the year following the owners death. If you are age 72 you may be subject to taking. Generally for individuals or employees with accounts who die prior to January 1 2020 designated beneficiaries of retirement accounts and IRAs calculate RMDs using the.

Use younger of 1 beneficiarys age or 2 owners age at birthday in year of death. For assistance please contact 800-435-4000. Use one of these worksheets to calculate your Required Minimum Distribution from your own IRAs including SEP IRAs and SIMPLE IRAs.

RMD amounts depend on various factors such as the beneficiarys age type of beneficiary and the account value. Claim 10000 or More in Free Silver. Beneficiary Date of Birth mmddyyyy.

You can also explore your IRA beneficiary withdrawal options based. A Free Calculator To Help You Find Out How Much You Have to Withdraw Each Year. Discover Fidelitys Range of IRA Investment Options Exceptional Service.

Determine beneficiarys age at year-end following year of owners. If you were born. Get your own custom-built calculator.

More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. Request Your Free 2022 Gold IRA Kit. Determine the required distributions from an inherited IRA The IRS has published new Life Expectancy figures effective 112022.

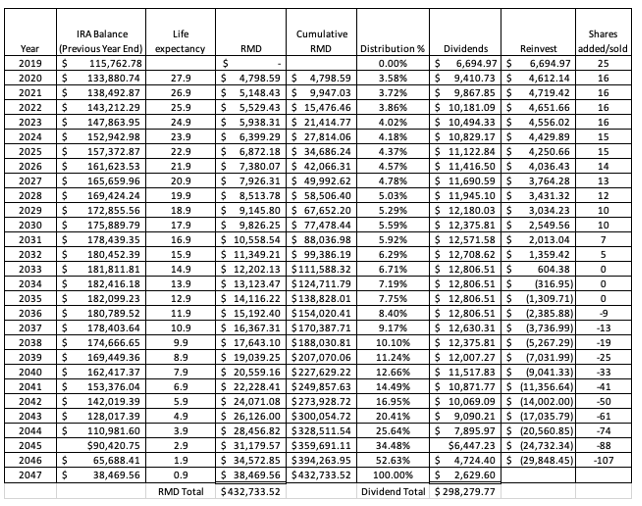

Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year. Traditional RMD Calculator This calculator is undergoing maintenance for the new IRS tables. We offer bulk pricing on orders over 10 calculators.

Account balance as of December 31 2021 7000000 Life expectancy factor.

Required Distributions On Inherited Retirement Accounts Reduced In 2022 Putnam Wealth Management

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

The Inherited Ira Portfolio Seeking Alpha

Avoid This Rmd Tax Trap Kiplinger

Sjcomeup Com Rmd Distribution Table

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

After Death Required Minimum Distribution Rules After The Secure Act Dbs

Required Minimum Ira Distributions Tax Pro Plus

Calculating The Required Minimum Distribution From Inherited Iras Morningstar

Required Minimum Distributions Rules Heintzelman Accounting Services

The Inherited Ira Portfolio Seeking Alpha

Your Search For The New Life Expectancy Tables Is Over Ascensus

Mandatory Ira Withdrawals The Elder Law Firm Of Robert Clofine

Your Search For The New Life Expectancy Tables Is Over Ascensus

Required Minimum Distribution Calculator

Your Search For The New Life Expectancy Tables Is Over Ascensus

Required Minimum Ira Distributions Tax Pro Plus